What’s The Difference Between Gold And Bullion?

Gold includes all forms, like jewellery and ways to trade like coins and bars.

Bullion includes the physical forms of precious metals which also traded, like gold, silver and platinum.

Bullion is usually stamped with its weight and the percentage of its pure precious metals content, or purity, so investors can determine its worth.

2 Reasons to invest in gold

1. Preservation. Gold’s long history makes it an attractive, secure form of long-term investment and wealth preservation. Its value continues to grow slowly, though it is less impacted by inflation and volatility.

2. Portfolio diversification. A portfolio is made up of many different types of assets that generally reduce risk.

Gold is often oppositely correlated to the stock market, in a sense that even as the stock market falls, gold may remain steady or prices may increase. This does not mean that one should only invest in gold, but Including gold can help diversify your portfolio and provide some protection against unforeseen events.

What Is Bullion?

Bullion is gold and silver that is officially recognized as being at least 99.5% and 99.9% pure and is in the form of bars or ingots. Bullion is often kept as a reserve asset by governments and central banks.

Bullion can sometimes be considered legal tender, most often held in reserves by central banks or used by institutional investors to hedge against inflationary effects on their portfolios. Approximately 20% of mined gold is held by central banks worldwide. This gold is held as bullions in reserves, which the bank uses to settle international debt or stimulate the economy through gold lending.

Purchasing and Investing in Bullion

1. Physical Form

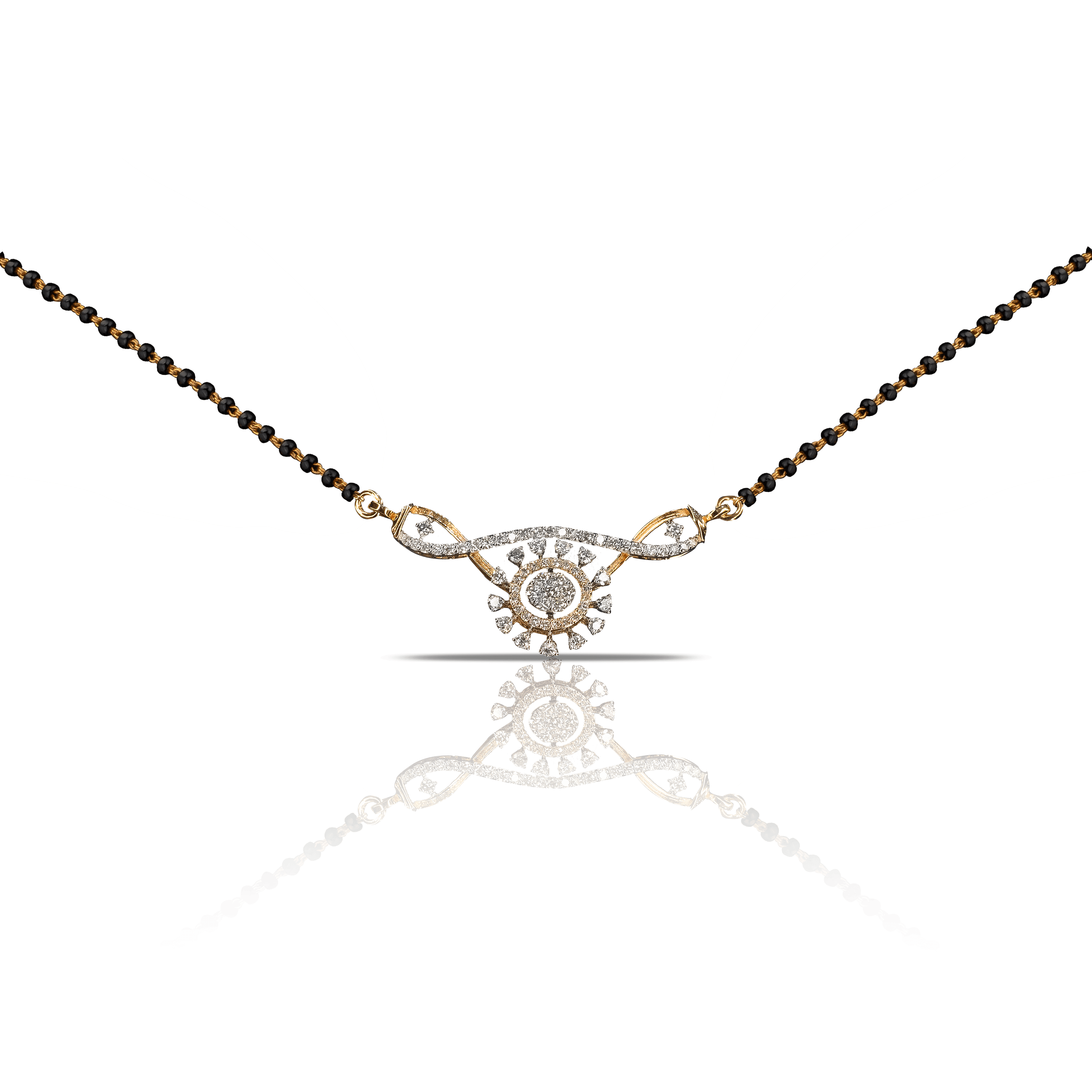

An investor who wants to purchase precious metals can purchase it in physical bullion form. Gold or silver bars or coins can be purchased from a reputable jeweller.

2. Exchange-Traded Funds (ETFs)

ETFs are funds that contain a collection of securities. With Gold or Silver ETFs, the underlying asset might be gold certificates or silver certificates, and not the physical bullion itself.