Let’s take a look at the historic price of gold in the past half century

https://www.bankbazaar.com/gold-rate/gold-rate-trend-in-india.html

Before we understand why the price of gold fluctuates, let us know what factors determine the gold price.

1. The price of the US Dollar.

Gold is inversely related to the value of the United States dollar. When the U.S. dollar appreciates, the price of gold falls. A depreciating dollar is likely to increase the price of gold by increasing its demand, as more gold will be purchased as an investment when the dollar weakens.

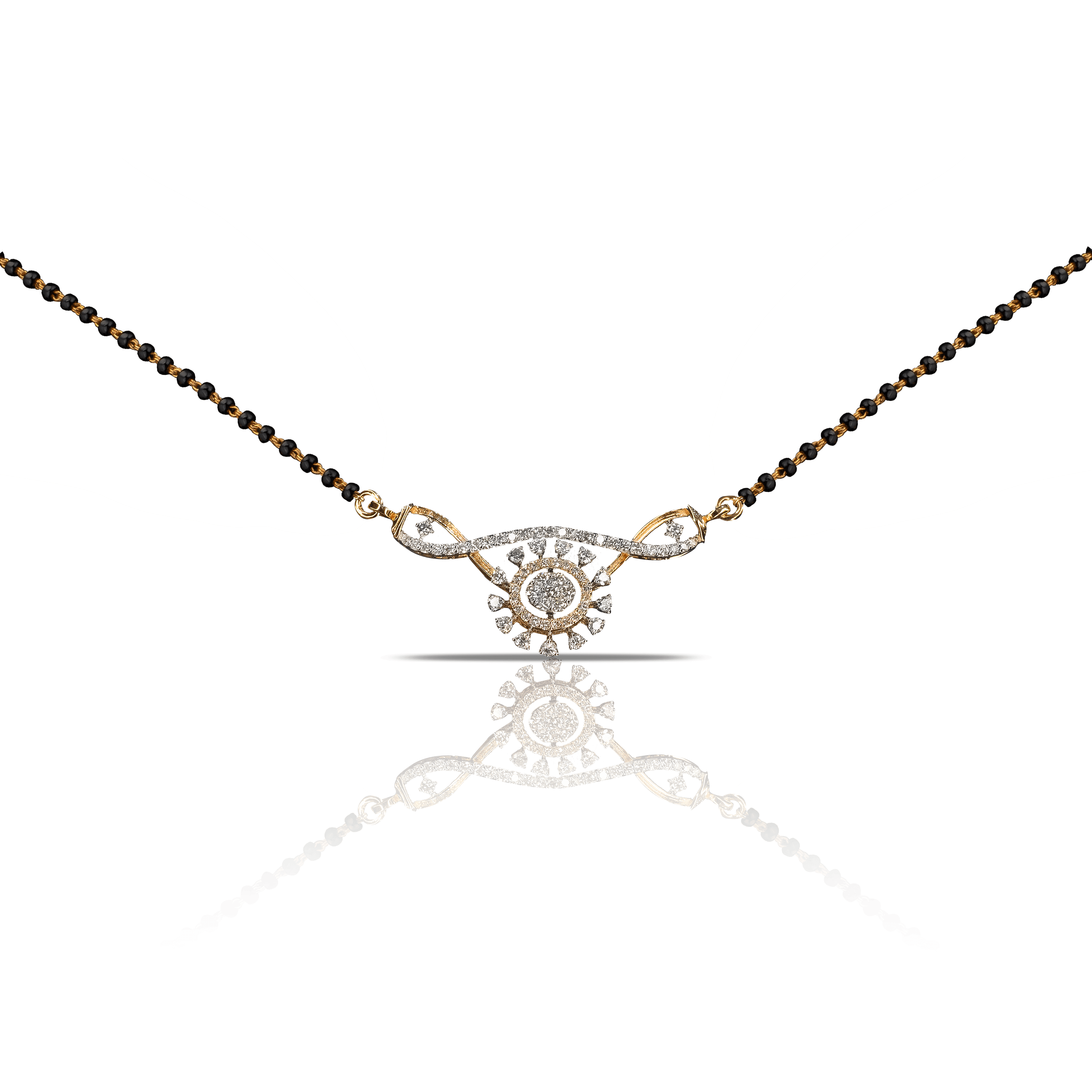

2. Increasing Jewelry and Industrial Demands

The most common and admired use of gold is in jewelry. Gold is also widely used for technology and industrial uses. As the desire for these goods increase, so does the price of gold.

3. Central Bank Reserves

Reserves of many nations across the globe are entirely based on gold.

4. Protection of Your Wealth

When economic situations are unstable, gold is a refugee for many investors because of its enduring value. It is a safe haven for investors during economic uncertainties.

5. Gold’s Demand in The Future

Restricted mining capacity, shortage in the supply of gold is another factor for fluctuations in gold rates.

WHAT FACTORS MAKE THE PRICE OF GOLD FLUCTUATE?

1. Inflation

Governments, institutions, and investors prefer to invest their cash reserves in gold since currency loses its value over time. Gold acts as a hedge against inflation, and as a result, the demand for gold rises and prices move north.

2. Foreign government policies

Global government policies impact the demand for gold and cause price fluctuations. For example, any increase announced in US Fed interest rates results in money flowing into government securities and the banking system from gold reserves.

3. Currency Movements

India pays for gold imports in foreign currency for domestic consumption. Any movement in the currency affects the gold rate movement as well. When the Rupee weakens against the Dollar, the gold rate becomes costlier and vice versa.

4. Geopolitical Crisis

A geopolitical crisis forces investors out of financial assets (eg: equity and debt) into stable real assets like gold and silver. Gold is preferred as it is more liquid. Wars, epidemics or oil-embargoes are crises that affect gold prices globally.

5. Economic Growth

Normally, an increase in GDP growth is positive for equities and negative for gold prices. That explains why gold prices started falling post November when Trump announced his tax cuts and infrastructure spending.

6. Supply and Demand

At best, consumer demand for gold can act as a support for gold prices.

Key takeaway:

*It is a myth that seasonal demand for jewelry governs the price fluctuations of gold. *The fact is gold prices are affected,not by a single factor, but various conditions and policies of nations to protect their economies.